Keeping your accounts payable (AP) cycle running smoothly is a big deal if you want healthy cash flow and happy vendors. The AP process—handling invoices from the moment they arrive to the final payment—can get messy fast if you’re still doing things by hand. Late payments, slip-ups, and even fraud can sneak in when you’re stuck with manual work. Many businesses struggle with higher costs and frustrated vendors just because their AP system isn’t up to speed.

Thankfully, technology’s here to save the day. It can take over the boring, repetitive stuff, cut down on mistakes, and make everything more accurate. In this piece, we’ll break down the AP process step-by-step and share some ways tech can make it faster, safer, and cheaper.

Understanding the Accounts Payable Process

It all starts when an invoice lands in your inbox—or your actual mailbox. Vendors send them in all sorts of ways: emails, paper, or even fancy electronic formats. Once you’ve got it, you log it into your system to keep things moving. If you’re still dealing with stacks of paper, good luck—those invoices have a way of disappearing when you need them most, slowing down approvals and payments.

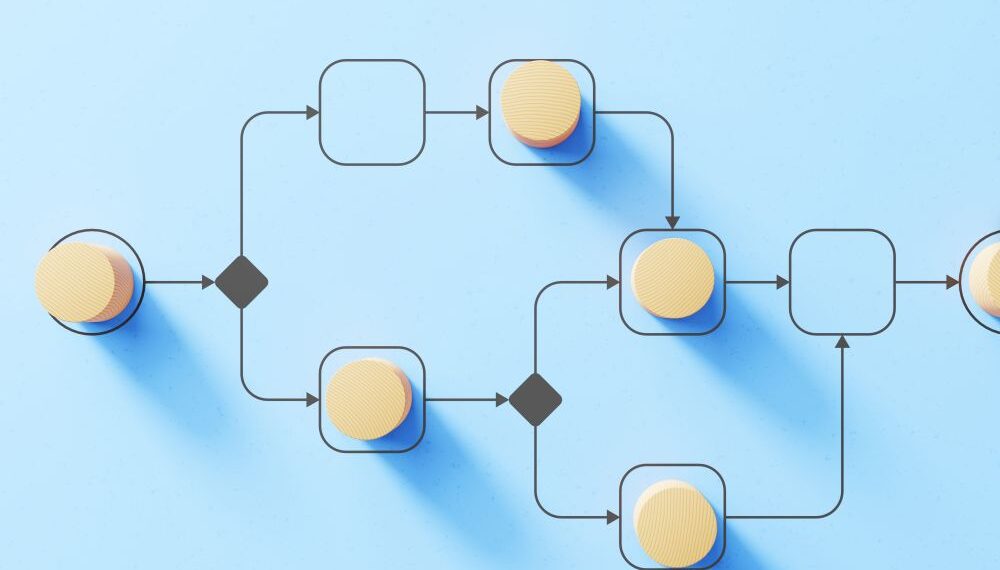

Next up is checking the invoice. You’ve got to match it with purchase orders and delivery receipts to make sure you’re paying for what you actually got. If something’s off, you’re stuck sorting it out, which eats up time. Once everything checks out, it’s on to approvals—managers or finance teams give the green light based on your company’s rules. After that, it’s payment time: checks, bank transfers, wire payments, or even virtual cards. Finally, you wrap it up with reconciliation—making sure your payments match your books for audits and peace of mind.

If you’re interested in learning more about this, you can see how Medius explains the accounts payable process and get in-depth insights.

Implement Automated Invoice Processing

Automated invoice processing is a game-changer. Instead of typing out every detail by hand, software scans and pulls info like invoice numbers, vendor names, and amounts. Tools with optical character recognition or AI can handle this in a snap, cutting out human errors and speeding things up.

Plus, it gets invoices to the right people without the usual back-and-forth. Paper approvals can drag on forever, especially if multiple people need to sign off. Automation routes everything instantly, so vendors get paid on time and you dodge those pesky late fees.

Use AI-Powered Data Extraction and Validation

Artificial intelligence doesn’t just grab data—it double-checks it too. AI-powered AP tools can spot weird incidents like duplicate invoices or mismatched vendor info in real time. That’s a huge win for catching fraud before it’s a problem and keeping your finances on point.

The cool part? Machine learning gets sharper over time. The more invoices it sees, the better it gets at flagging issues. It’s like having a super-smart assistant who’s always learning, making your controls tighter and reducing the chance of missing something big.

Leverage Electronic Payments

Paper checks? They’re on their way out. Electronic options like ACH transfers, wires, or virtual cards are faster and safer. They cut costs compared to mailing checks, and you don’t have to worry about them getting lost or forged.

Virtual cards are even better—they give you a unique number for every payment, so fraud’s way less likely. You can even set limits on what you’re spending with each vendor. It’s a quick way to pay without the hassle, and it saves your team a ton of paperwork.

Integrate AP Software With ERP Systems

Hooking your AP software up to an ERP system is like giving your finances a live feed. You get real-time updates on invoices, cash flow, and payment timelines, which makes planning so much easier. No more guessing about what’s coming up.

It also cuts out the tedious task of matching records by hand. When everything syncs automatically, your numbers stay consistent, and your reports are spot-on. That’s a big deal for staying transparent and keeping up with accounting rules.

Utilize Cloud-Based AP Solutions

Cloud-based AP solutions are all about flexibility. You can access them anywhere—no need to be stuck at the office. That’s perfect for remote teams or businesses with locations spread out. And unlike old-school systems, you’re not stuck maintaining hardware or chasing updates.

Security’s built in too, with features like encryption and multi-factor logins. Your data stays safe, and regular backups mean you’re covered if something goes wrong. It’s an easy way to handle invoices and approvals while keeping IT costs low.

Streamline Approval Workflows With Digital Tools

Old-school approval processes are a bottleneck waiting to happen. Digital tools let you set up clear steps for who approves what, so invoices don’t sit around. Team members can even sign off from their phones—no more chasing down signatures on paper.

On top of that, you get a record of every approval—who did it and when—which is gold for audits and staying compliant. Faster approvals mean quicker payments and fewer headaches all around.

Bottom Line

Using tech to tune up your accounts payable cycle is a no-brainer. It saves time, boosts accuracy, and keeps things secure. Whether it’s automating invoices, tapping into AI, or going digital with payments and approvals, there’s a tool for every step. Add in cloud solutions and ERP tie-ins, and you’re looking at lower costs, better cash flow, and vendors who actually like working with you.

In today’s world, slogging through AP by hand just doesn’t cut it. Tech-driven solutions can transform how you handle finances, keeping you competitive and on the right side of regulations. If your AP process could use a boost, now’s the time to check out what automation can do for you—it’s an investment that pays off big.